IGNOU Assignments Solutions | Ignou Question Paper & Updates

Bachelor of Commerce (B.Com) – INCOME TAX LAW & PRACTICE Solved Assignment Answer | BCOC 136 | 2021-2022

Free BCOC 136 Solved Assignment Answer | INCOME TAX LAW & PRACTICE | For July 2021 – June 2022

IGNOU BCOC 136 Solved Assignment, This assignment is the curriculum of the Bachelor of Commerce (B.Com) program. For other courses, students check our website categories section to find their courses and assignments over there.

BCOC 136 INCOME TAX LAW & PRACTICE Solved Assignment 2021-2022

IGNOU BCOC 136 INCOME TAX LAW & PRACTICE assignment is 100 marks. There are only three sections – A, B, & C. Students have to answer all the questions. Download IGNOU BCOC 136 Assignment free without any registration, Students can easily download the IGNOU assignment question paper from the official website of the university. They are not required to pay any fees or charges for this.

| Title Name | BCOC 136 Solved Assignment 2021-2022 | INCOME TAX LAW & PRACTICE |

| University | IGNOU |

| Service Type | Solved Assignment (Soft Copy/Q&A form) |

| Course | B.Com |

| Language | English |

| Semester | Session: July 2021 – January 2022 |

| Short Name | BCOC-136 |

| Assignment Code | BCOC-136/TMA/2021-2022 |

| Product | Assignment of BCOC-136 | 2021-2022 |

| Submission Date | Valid from 1st July 2021 to 30th June 2022 |

| Assignment Pdf | Download Now |

How to get INCOME TAX LAW & PRACTICE, BCOC 136 Solved Assignment?

It is always good to solve the assignment by yourself. Because it helps the students in the whole study. It also helps them in preparing for the exam. So that the question that comes in the exam can be solved easily.

If someone is unable to solve the assignment, so don’t worry we have solved this assignment for you, you only need to click the link one by one and get all the answers to this assignment sequence-wise. And if not, then our team is working on it and you will be available soon.

The answer of BCOC 136 | INCOME TAX LAW & PRACTICE | Solved Assignment 2021-2022:

Note: Attempt all questions. The marks for each question are indicated against it.

Section-A (This section contains five questions of 10 marks each)

1. Explain the procedure of Tax payment and Filing of return of Income.

2. Explain the provisions relating to Gratuity u/s 10 (10) and Commuted pension u/s (10)10A.

3. What is Annual Value? Explain the various deductions which are allowed from annual value u/s 24.

4. Explain the provisions relating to exemption of income for the non-resident assessee.

5. Discuss the provisions relating to Voluntary Retirement u/s 10 (10C).

Section-B (This section contains five short questions of 6 marks each)

8. Explain the provision relating to ‘Profits in Lieu of Salary’.

10. Find out the taxable value of the Interest-free/Concessional loan as per rule 3(7) (i).

Section-C (This section contains two short questions of 10 marks each)

11. Write a short note:

a) Defective return u/s 139(9)

b) Deduction u/s80E

c) Entertainment allowance u/s 16 (ii)

d) Bond washing transactions

12. Explain the following questions:

a) Provisions of rent-free accommodation when accommodation is provided by any other employer

b) CBDT

c) Provisions relating to Income from assets transferred to daughter in law u/s 64 (1) (vi)

d) Provisions relating to set off of losses from owning and maintaining race horses u/s 74 A (3)

Wrapped Up

- For More BSCG Assignments – BSCG Solved Assignment

- For Hand Written Assignments – Click here

For more Updates join our Telegram Group and also for your inquiry you may comment here or mail us –info@ignouassignmentssolutions.in

Telegram Group – Click Here

- bcoc 136 solved assignments

- ignou assignment 2020

- ignou assignment 2021

- ignou assignments

- ignou bachelor assignments

- ignou solved assignment

- ignouassignmentstatus

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | 31 | |||

Recent Posts

- IGNOU Hall Ticket June 2023 – Check TEE June 2023 Admit Card Ignou

- IGNOU BHIC 104 Previous Year Question Paper & Important Question | Arts (Honours) Ignou Question Paper

- IGNOU BHIC 103 Previous Year Question Paper & Important Question | Arts (Honours) Ignou Question Paper

- IGNOU BHIC 102 Previous Year Question Paper & Important Question | Arts (Honours) Ignou Question Paper

- IGNOU BHIC 101 Previous Year Question Paper & Important Question | Arts (Honours) Ignou Question Paper

Recent Comments

Top Categories

Sign Up to Our Newsletter!!!

IGNOU BCOMG Previous Year Question Paper & Important Question | Bachelor of Commerce General Paper

Evaluate the guiding principles for shelter provisions.

Bachelor’s Degree Programme (BAG) - SOCIAL STRATIFICATION Solved Assignment Answer | BSOE 148 | 2021-2022

Write a note on Community based Disaster Management (CBDM).

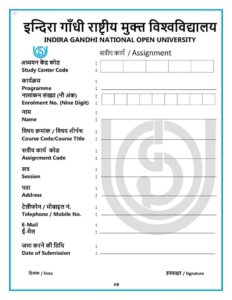

IGNOU Assignment Front Page Format | Download Free First Page of IGNOU Assignments 2022

Master's Degree Programme (MA Hindi) - हिंदी उपन्यास - 1 Solved Assignment Answer | MHD 14 | 2021-2022

IGNOU BBYCT 137 Previous Year Question Paper & Important Question | I.A.S.

IGNOU BCHCT 137 Previous Year Question Paper & Important Question | I.A.S.

Bachelor’s Degree Programme (BSCG) - HUMAN GEOGRAPHY Solved Assignment Answer | BGGCT 132 | 2021-2022

Bachelor’s Degree Programme (BSCG) - Linear Algebra Solved Assignment Answer | BMTE 141 | 2021-2022

Bachelor of Art General & Honours (BAG) - English Language Teaching Solved Assignment Answer | BEGS 185 | 2022-2023

Bachelor of Art General & Honours (BAG) - Business Communication Solved Assignment Answer | BEGS 186 | 2022-2023

Bachelor of Art General & Honours (BAG) - English Communication Skills Solved Assignment Answer | BEGAE 182 | 2022-2023

Master's Degree Programme (MSW-C) - Fields of Counselling Solved Assignment Answer | MSW-016 | 2021-2022

IGNOU ECO 06 Previous Year Question Paper & Important Question | Commerce Ignou Question Paper

IGNOU ECO 05 Previous Year Question Paper & Important Question | Commerce Ignou Question Paper

IGNOU ECO 03 Previous Year Question Paper & Important Question | Commerce Ignou Question Paper